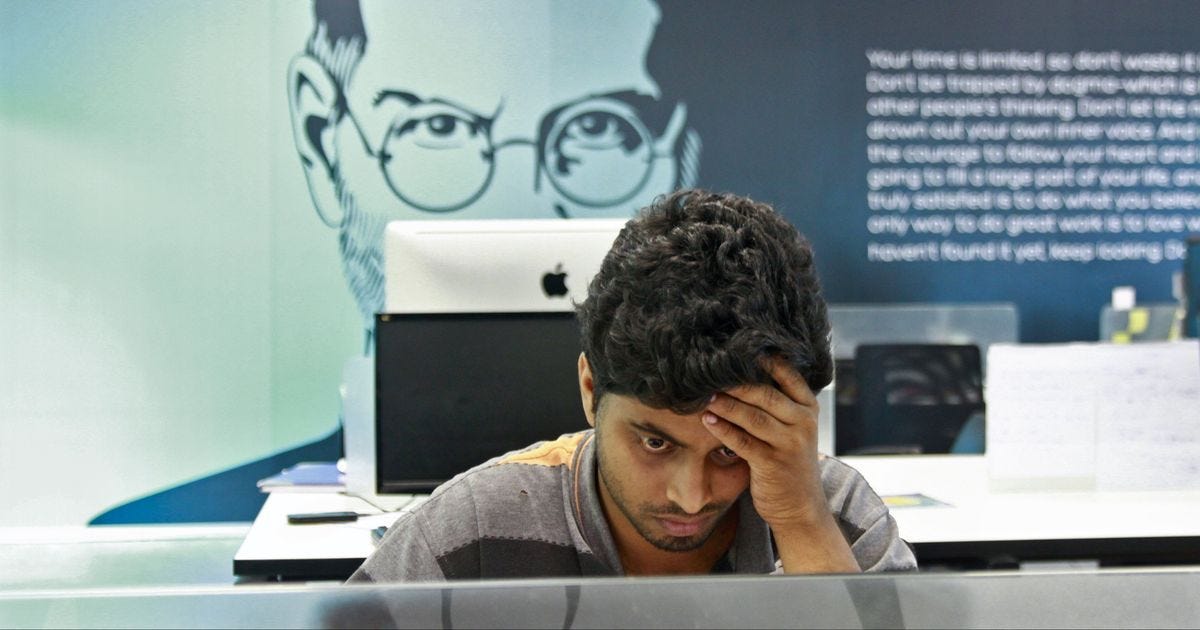

Financial Instability and Insecurity of the current generation

There is a chain reaction of consequences from the ongoing financial insecurity in the country.

The problem

There have been layoffs, as in employees asked to leave the company over the past few months. You may have heard of this as either some friends that you know may have experienced it, or family, or you have read it on social media or the newspaper's or just opened LinkedIn everyday. This has happened in the most prominent companies such as Google, Microsoft, Amazon and so on and recently even financial agencies such as Goldman Sachs.

This has taken a huge toll on individuals and have had different ramifications based on their personal circumstances. However not to worry as the companies themselves will survive as they have done this to cut costs and keep going in the long term.

The Situation and consequences for India

In India there have been layoffs by the multinational companies such as Amazon and Goldman Sachs. There have also been layoffs by the various Startups such as Sharechat, Dunzo and Rebel Foods as well. This has had many repercussions on the people who have been laid off. The age range of those that been laid off is from those who just started working to those about 10 years older who would be at the mid level of the company. This means that the current generation is facing massive financial instability which they are unable to cope with. The reasons are given below:

There are many Indians who take loans for many purposes and have to pay monthly Easy Monthly Installments or EMI’S which are usually taken out from their account on a monthly basis, but with no salary coming in suddenly it becomes difficult. There are also issues with regards to payment of children’s school fees and expenses, household expenses and sending money to look after their parents. In short there is the debt cycle of loan debt, credit card debt which needs constant financial infusion to tide over it. There are also Indians who have invested poorly and lost a lot of money as a result of it and then lost their job. This puts their financial situation under extreme strain especially if they have to provide for their family. The outcome of this strain was seen recently in a case in Bangalore where a man who worked in a Technology firm killed his daughter then tried to kill himself as he did not have money to feed her.

Another consequence of these layoffs is the unique problem in India faced mostly by the men which is of getting married. This usually takes place with groom themselves looking for suitable wives or the parents of both the bride and the groom searching for eligible suitors. For the parents of the bride the groom must be financially stable and secure in order to look after their daughter and eventually their family. This is why they don’t like or prefer men with private sector jobs as they could loose their job at any time. They much prefer a man with a government sector job as their is stability, security and various financial benefits as well. However getting government jobs are extremely difficult as the competition is cut throat for limited posts and for a place in the civil service. So this is why presently some have chosen not to get married until they have some sort of job security.

The major cause

Among the root causes of all is thought to be the cold logic of capitalist contracts. Marking to market is continuous & costs that were normal yesterday might spike today. Demand that is normal today might collapse tomorrow as a result of which companies sell their assets. Then to reduce costs they remove a number employees. This can be squarely put on the capitalist dynamic and not individual corporations.

Some Helpful Ways Out

One of the first major ways to help in such insecurity is for the individuals to start their own consultancy and provide their services to various companies and clients. This will bring in a steady flow of income as they build and develop relationships with their clients. The next way is through pragmatic financial planning and management. There should be zero risky investments, zero short term investments or get rich quick investments and more safe investments which will help in the long run. Finally all individuals who have been laid off must update their skills and diversify them so that they offer more services and can apply for more job roles.